As Mediavision summarizes the full year of 2021 on the Swedish video market, it is concluded that standalone SVOD revenues hit a new record. The market shows continued growth, but Mediavision points out that it primarily stems from households signing up to additional services, rather than new households entering the market.

Revenues from standalone SVOD (S-SVOD) subscriptions amounted to approximately 5 billion SEK for the full year of 2021 – a new record. This is concluded in Mediavision’s analysis of the Swedish streaming market for the fourth quarter and full year of 2021.

Since 2017, the Swedish S-SVOD market has grown at an annual rate (CAGR) of +10 percent. Initially, growth was predominantly driven by more and more households subscribing to an S-SVOD service. However, growth as measured in number of new households has diminished over the last two years. In 2021, approximately 6 out of 10 Swedish households subscribed to an S-SVOD service – a stable share compared to 2020. This figure is in line with the number of households subscribing to a digital pay TV service, although penetration for pay TV has remained stable for a longer period of time.

In 2021, Mediavision concluded that growth instead was driven by households signing up for a higher number of services (i.e., stacking). On average, a Swedish household subscribes to 2.1 standalone SVOD services today. However, a price war has started as new S-SVOD services have entered the market at a significantly lower price point compared to market average. Consequently, growth in stacking has brought upon a lower average expense per subscription, amounting to 118 SEK per month in 2021 (-3 percent YOY).

– The standalone SVOD market continues to show healthy growth, even during 2021 that was characterized by maturity, comments Natalia Borelius, senior analyst at Mediavision. The primary driver of growth is stacking, i.e. additional subscriptions rather than new households – existing households are simply paying more for their supply of services. Nevertheless, the price war (ignited by e.g., Disney and HBO) has pushed down average expense per subscription – despite several other, big services imposing price hikes. Going into 2022, we expect an eventful year as price and packaging strategies increase in importance on a maturing Swedish market.

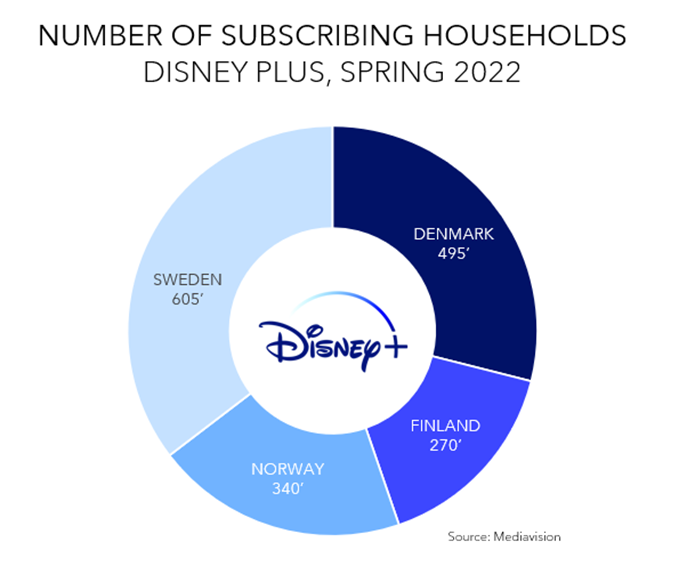

On September 15th in 2020, Disney Plus entered the Nordic region. After only 24 months, the service has attracted more than 1.7 million subscribing households on the fiercely competitive Nordic market. The service has especially gained a strong position within the kids and family segment.

This Thursday marks the second anniversary of Disney Plus in the Nordics. In only 24 months, the service has attracted more than 1.7 million subscribing households in Denmark, Norway, Finland, and Sweden – which means that it is the fourth largest service in the region.

Disney Plus’ rapid success can be explained by its clear positioning within the kids and family segment and an attractive price point. As Mediavision’s Content Analysis shows, approximately a fifth of Disney Plus’ total content library (in terms of total hours) is within the kids and family genre – and according to the consumers’ evaluation, Disney Plus outranks all competitors in this segment.

-It is not an overstatement to say that Disney Plus launched with a bang on the Nordic market. The service reached a household penetration of 10% in the Nordics in only two weeks – boosting stacking and subsequently household spend. However, a lot has happened these past two years, says Natalia Borelius, senior analyst at Mediavision. The streaming market is saturating, causing actors to search for new ways to boost subscriptions and increase revenues. Many actors are betting on adding hybrid subscription/advertising tiers – and Disney Plus is one of them. Mediavision follows these developments closely – and will shortly release new figures on the Nordic SVOD market’s development so far during the second half of 2022.