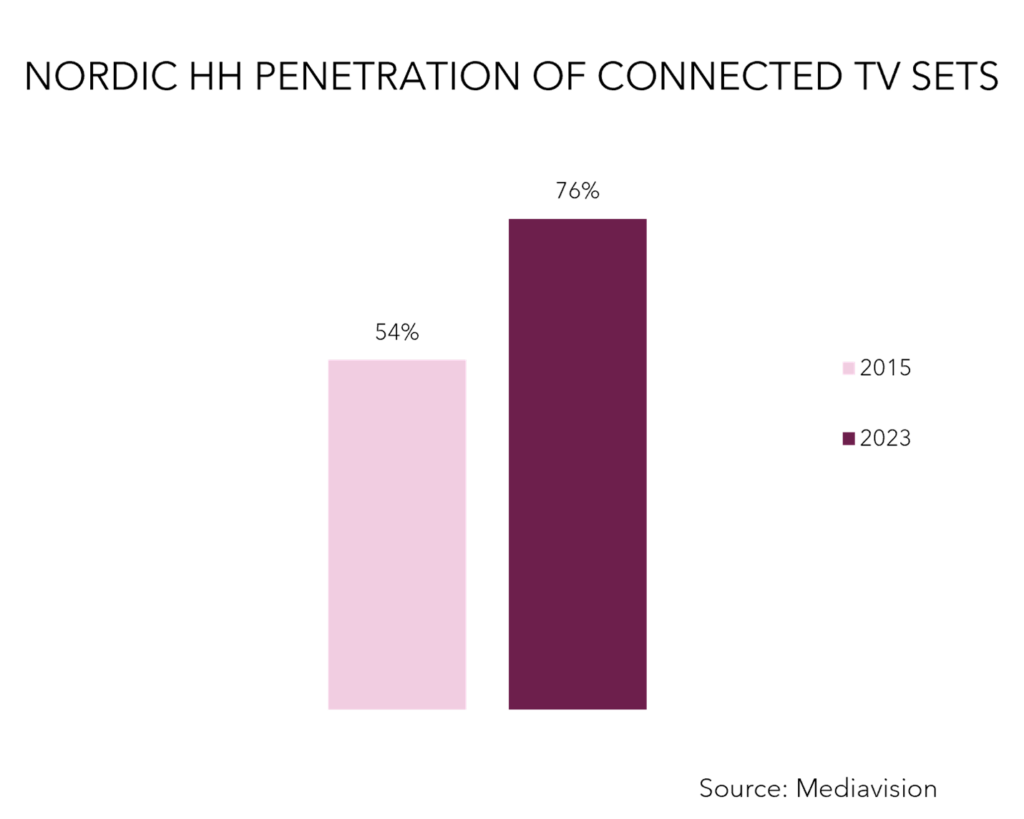

As TV viewing has moved to streaming, the demand for internet connected TVs has grown rapidly into today being the norm. As many as 75 percent of the Nordic households now have a TV set connected to the internet. Most TV manufacturers are also moving closer to content, either through own services or through the supply of content from others. This will likely mean further increased competition going forward.

70 percent of the Nordic households today have a paid streaming service. Over some time now, this has also spurred the demand for internet connected TVs. As many as 75 percent of the households in the region have at least one TV set with internet connection. This can be either through external devices such as Apple TV, Google Chromecast etc, or it can be integrated into the TV set itself. The transition into streaming has clearly pushed the demand for these products in general.

Mediavision analysis shows that it is especially the uptake of built-in, integrated, connections that grow the fastest. Almost all newly produced TVs have the possibility of built-in internet connections. This has also implied a declining demand for external media centers. This is concluded in Mediavision’s new Consumer Device Report.

In the boom of connected TVs, we also see new businesses emerging. One example is “FAST”, an ad-funded streaming, free of charge for the consumers. This seems to be a new development partly pushed by the TV manufacturers.

– We now see a large majority of Nordic households having smart TVs, comments Fredrik Liljeqvist, senior analyst at Mediavision. This has also enabled more actors, like the TV manufacturers, to be involved in the content and aggregation business. Manufacturers like LG, Phillips, Samsung etc are today providing content services to consumers. This will likely increase competition going forward, both over viewers and advertisers.

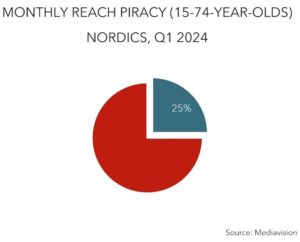

Piracy has been a challenge for the Nordic media market for many years. Despite efforts by several actors to limit piracy, illegal consumption of films, series and live sports is growing in most Nordic markets. An increasing number of households also pay for illegal TV services, so-called illegal IPTV.

Today, 25 percent of all 15-74-year-olds in the Nordics say they have downloaded or illegally streamed films, series or live sports in the last month. This means that there are roughly 5 million pirates in the Nordics, which is about 400,000 more than the previous year. This is evident from recently published data from Mediavision.

In addition, an increasing number of households choose to subscribe to illegal TV services, so-called illegal IPTV (Internet Protocol Television). There are currently around 1.3 million households in the Nordics that pay to gain illegal access to thousands of TV and streaming services this way. That is an increase of 16 percent compared to last year.

– Piracy is still a problem in the Nordics. Financial pressure on households combined with generally increased prices for legal alternatives are factors that have likely contributed to growth, comments Natalia Borelius, analyst at Mediavision.