Last week Storytel and Spotify announced that they will enter a partnership, making audiobooks available to Storytel subscribers via Spotify’s Open Access Platform. This is all good news for consumers that subscribe to both services, as they will now get easier access. But who is the real winner in this deal when it comes to the actors – the content or platform provider?

Both Storytel and Spotify are leading in their respective segment of the audio market. Spotify has dominated the music streaming market since the beginning and has almost 160 million subscribers across 178 markets. In Sweden, Mediavision concludes that 1.6 million subscribed to the premium service in Q1 2021. The Swedish music streaming market is mature and stagnating; just below half of all households have a music streaming subscription and penetration has been stable for the past two years.

The Swedish audiobook market, on the other hand, has grown substantially during the same period, i.e. since Q1 2019. But this market is now also showing signs of maturity. Penetration is almost 20% and growth has gone from double to single digit over the past year. Storytel is the leading actor, but on a significantly smaller segment of the audio market which, in this case, makes its position weaker than Spotify’s. Competition is fierce and there are other upcoming services like Nextory and Bookbeat.

Both Spotify and Storytel find themselves “trapped” on a maturing market, but with different challenges. Growth will need to be generated from other areas, which can be either new markets (as Storytel gaining access to new potential customers via Spotify) or new content offerings to fight churn (as Spotify gaining access to Storytel’s library). In that sense both actors appear to gain from the partnership. But is it really a win-win-situation in the long run?

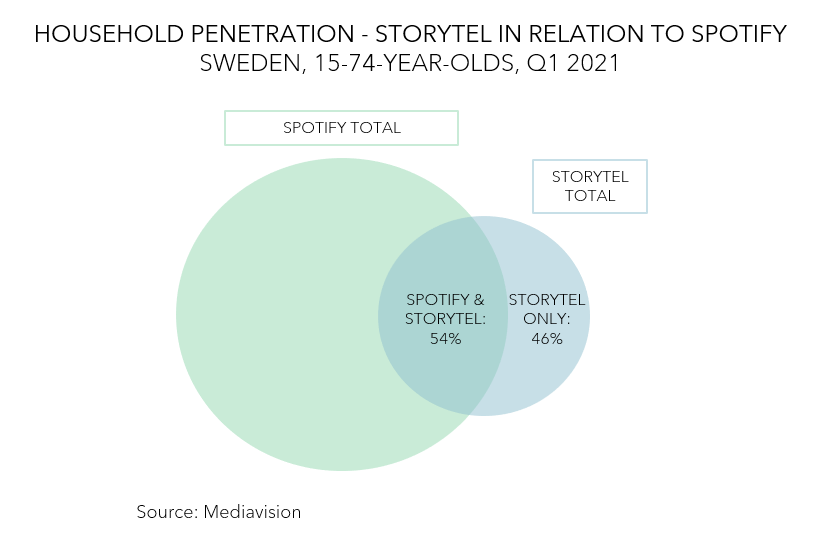

To begin with, Mediavision analysis points at Spotify being almost five times the size of Storytel in subscribing households – and that is only on the Swedish market. In stock market value, the factor is 25 (Storytel is valued at approx. 15 bn SEK and Spotify at 45 bn USD). Spotify holds a dominant position on the audio market and craves content to feed consumers and increase stickiness. This is where Storytel comes into the picture. The question for Storytel is what the long-term value of this partnership is. It will gain access to new potential customers at the risk of making Spotify even stronger in building customer relations. E.g who would the consumer turn to if they had to choose between Spotify and Storytel? Well, the figures give us some guidance: in Sweden, more than 50% of Storytel’s customer base overlap with Spotify. In addition, share-of-listening is 10 times higher for Spotify than for Storytel. When the partnership was announced Storytel’s stock price jumped +20% in just one day. The Spotify stock price barely moved. The market seems to think that Storytel is to gain the most from this partnership. Time will tell.

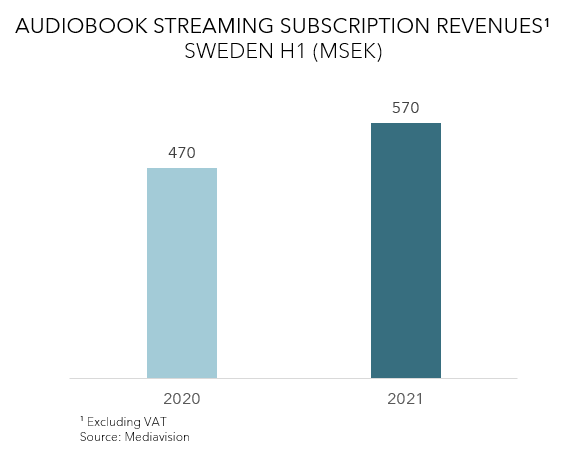

The Swedish audiobook market shows signs of strength in Mediavision’s latest analysis. Total revenues for the Swedish audio streaming subscription market grew by SEK 100 million in H1 2021, compared to the same period in 2020. There are however indications of household penetration approaching maturity.

Recent years have been eventful for the Swedish audiobook industry. Heavy investments from several actors have resulted in a tight race for market shares – and the services have been rewarded with a healthy influx of customers over the last years. There are, however, signs of the industry reaching maturity, as Swedish household penetration remains at approx. 20% or close to 800 000 subscribing households (15-74-year-olds) – a stable figure YOY.

Mediavision estimates that the Swedish audiobook streaming subscription revenues amounts to SEK 570 million (excluding VAT) in H1 2021, implying a growth of SEK 100 million. So, what has led to this, as household penetration is unchanged? The straightforward answer is consumption and packaging. The services are adjusting their packaging strategies – and raising prices – as they increasingly target ‘the whole family’, offering more streams per subscription. Multiple streams packaging is currently driving growth in revenues.

Industry News

Viaplay to Launch in 5 New Markets

By the end of 2023, Viaplay will be available in 16 countries – the five new markets being the UK, Canada, Germany, Austria, and Switzerland. Hence, NENT has upped it’s target for Viaplay subscribers to 12 million by the end of 2025.

Amazon Prime Launched in Sweden

Following the launch of Amazon.se in late 2020, Amazon has now made its premium subscription offering Amazon Prime available in Sweden. The Prime membership includes fast and free delivery, in addition to subscriptions to Amazon Prime Video and Prime Gaming.

Discovery+ Announces New Original Series

Gustav Lindh and Clara Christiansson Drake will star in the latest original series announced by Discovery+. The drama thriller series will be based on the book Hur man löser ett spaningsmord and is to be produced by FLX.

Netflix Tied Emmy Record with 44 Wins

With 44 wins at this year’s Emmy Awards, Netflix tied the record for most wins in one year set by CBS back in 1974. The Crown and The Queens Gambit each scored 11 wins in this year’s Emmy’s circle.

Telia to offer Netflix in Denmark

Telia will offer Netflix to its Danish customers in two new mobile subscriptions, priced at DKK 299 or DKK 219 per month depending on the amount of data included. Telia already offers the streaming services Discovery+, HBO and Spotify.

UK Broadcasters Nears Unified App

The BBC, ITV, Channel 4 and Channel 5 are hopeful of reaching an agreement by November to create a single streaming app. The app is aimed to act as a gateway to their catch-up and on-demand services.

‘Dune’ Earns USD 36.8 m in Overseas Debut

Legendary/Warner Bros.’s latest tentpole movie Dune had a strong opening overseas this weekend. The movie earned USD 36.8 million across 24 markets. The movie is set to debut in the U.S. on Oct. 22, simultaneously on HBO Max and in theatres.

Netflix Increases UK Studio Footprint

Netflix has announced a deal to lease the UK’s Longcross Studios. Netflix has previously committed to a USD 1 billion production budget for the UK across 60 productions including Sex Education, The Witcher and Bridgerton.

WarnerMedia Offers Discount on HBO Max

Following the removal of HBO from Amazon Prime Video Channels, WarnerMedia now offers HBO Max at a half-off discount for new and returning subscribers who has accessed HBO via this platform. This move is made in a bid to counteract subscriber losses.

Amedia & Bonnier Acquire Rights to Ligue 1

In an agreement reaching 2023/2024, Amedia and Bonnier have acquired the exclusive rights to the top tier of French male football, Ligue 1. In Norway, Nettavisen will stream the fixtures, while Expressen will stream in Sweden.

Mediavision in the News

Interest in sports keeps growing in the Nordics

Football is the sport that most Nordic viewers are interested in watching: close to 25% of Nordic 15-74-year-olds express an interest in viewing football via TV/online video, according to Mediavision.

Nordic Film Industry Weathers the Storm

More than a year after the first lockdown due to the COVID-19 pandemic, the Nordic film industry is showing its remarkable resilience and ability to adapt.

Hon leder HBO:s maxade comeback i Sverige

Streamingtjänsten HBO Nordic har tappat marknadsandelar i Sverige de senaste åren. Nu tror Europachefen Christina Sulebakk på en comeback med lanseringen av nya HBO Max.

Björn Ulvaeus bolag köper Perfect Day

Pophouse Entertainment, grundat av Björn Ulvaeus och Conni Jonsson, köper upp poddcastbolaget Perfect Day Media. De ska nu etablera sig på flera nya marknader – trots tidigare tung ekonomisk förlust.

Marie Nilsson: Hur många ljudboksaktörer kan den svenska marknaden svälja?

Ljudboksaktörernas kamp om lyssnarna hårdnar och i dag dansar de stora elefanterna i stort sett kring samma konsumenter. Marie Nilsson analyserar hur hållbar affärsmodellen för ljudböcker är.

Analyse: 9 millioner nordiske hustande abonnerer på digitale medietjenester

75 pct. af hustandene i Norden har abonnement på enten tekst-, lyd- eller videotjenester. Streaming af levende billeder er mest udbredt, men lyd følger tæt med.

Is HBO Max the perfect match for the Nordic audience?

Mediavision concluded that HBO Max and Discovery+ combined would make a significantly stronger customer offering, based on Nordic consumer preferences.

Disney Plus breddar sig för att nå fler: ”I streamingvärlden är det 'vi mot alla'”

Oväntat mycket har hänt sedan Disney Plus tog klivet in på den svenska marknaden för ett år sedan, närmare bestämt den 15 september.