Newsletter 14th of October: Major Challenges for the Film Industry

NEWSLETTER

14 October 2020

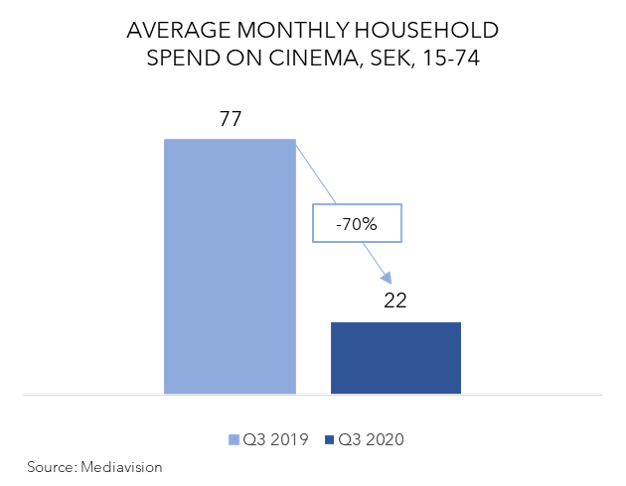

Mediavision’s Q3 analysis of consumer spend on media points towards a normalization, following substantial corona effects during the spring. Cinema, however, is an exception. The drop in consumer spend om films is currently at -70% year-on-year. The challenges for Swedish movie theatres have many similarities with what we now see in the UK and US.

Starting off with a glance at the current market situation (Mediavision will shortly release its’ full Nordic analysis), we can conclude that cinemas in Sweden are facing major challenges. After months of negative figures, visits are still down in Q3 by 65% on a YOY basis. Today, most Swedish movie theatres are open (albeit seat and spacing regulations). Hence, the question is more complex than just accessibility. An important factor is, likely, the distributors unwillingness to release blockbuster movies on theatres in today’s climate. An unqualified guess is that it will take quite some time before the situation has improved – at least until the pandemic is under control. Consequently, the low household spend on the movies in Q3 does not come as a surprise. Expenditures has decreased by 70% since last year.

The situation seems to be the same for movie theatres in many countries. This week we have learned that one of the major actors in the US, AMC Theatres, is in danger of running out of cash if the attendance to the theatres doesn’t improve drastically – and soon. In a public filing, the company reported that attendance at the 494 (of its 598) U.S. locations currently open, was down approximately 85%. Last week, another major actor, Cineworld, decided to temporarily close 660 outlets across the US, Great Britain, and Ireland. UK actor Vue has decided to close down a quarter of its outlets, in addition to cutting opening hours.

Another tough challenge is the delayed openings of blockbuster titles. Star Wars, Avatar, Jurrassic World: Dominon and West Side Story are just a few examples. The latest James Bond movie (No Time to Die) was recently announced a postponement (for the second time) to April 2021. This has sparked a US debate on how theatres are to outlast these difficult times. No wonder there is increasing discussions over “windowing” and the possible launch of major titles directly on TVOD. An example is Disney’s latest block buster Mulan that went straight to TVOD, available on Disney+ for $29.99. For the upcoming title Soul, Disney has announced a slightly different strategy. The film will be made available on Disney+ at no extra charge on December 25th.

So, is this a tipping point? Will the pandemic eventually cause a new order for the movie industry? The answer will of course depend on how well digital revenues (SVOD and TVOD) can compensate for the box office losses. It is not a wild guess that it will still take some time to figure out the “new new thing” for Big Movies.

Industry News

Disney & YLE Team up for Original Content

The Finnish production company Gigglebug Entertainment has signed a contract with Disney and YLE to produce the animated series The Unstoppable Yellow Yeti. This is the first time Disney creates original content with a Finnish production company.

Com Hem & Boxer Sign Deal with Discovery

In a new deal, Com Hem and Boxer have agreed with Discovery on continued distribution of the Discovery channels to its customers. In addition, Com Hem and Boxer launch Dplay as part of its offering in 2021, granting access to Allsvenskan and Superettan.

EU Presents Tougher Rules for Big Tech

The EU authorities will draw up a list of up to 20 large Internet companies, which in the future will be subject to new and much stricter rules than smaller companies. The new regulations aim to reduce these companies’ dominance on the market.

TV 2 DK Demands Refunds for Handball

TV 2 Denmark demands a financial compensation from Divisionsforeningen Håndbold and Dansk Håndbold Forbundthe following that the last season was not fulfilled due to the pandemic. The parties are currently engaged in negotiations.

TikTok Competitor Prepares for Stock Listing

American app Triller, a direct competitor to TikTok, aims to raise 2.2 billion SEK in capital in preparations for a stock listing. The app was launched already in 2015 and Swedish music industry profile Ash Pournouri is one of the co-owners.

Spotify Granted Another US Patent

Continuing its investments towards innovation, Spotify has obtained another US patent – for “methods and systems for personalizing user experience based on user personality traits”, to enable promotion of content and advertising based on personality traits.

Apple Presents iPhone 12

On Tuesday, Apple introduced the new series of iPhone 12. The new edition is compatible for 5G, has improved cameras, wireless chargers, and a more durable glass display. Further, Apple presented the new HomePod Mini.

AT&T Disinvests Stake in CME

American telecom giant AT&T has sold its stake in Central European Media to Czech investment firm PPF Group. AT&T was prior to the sale the largest shareholder, following AT&T’s acquisition of Time Warner in 2018. The sale was announced one year ago.

Mediavision in the News

Swedish Q3 media spending stabilises after coronavirus surge in Q2

Swedish household spending on media services stabilised in the third quarter at around SEK 1,400 per month, after substantial coronavirus effects in Q2, according to consultancy Mediavision.

Swedish media spend returns to pre-Covid levels

The amount spent by Swedish households showed signs of stabilisation in the third quarter after the effects from the Coronavirus crisis in Q2.

Nytt rekord för streamingtjänster i Sverige

Under årets tredje kvartal uppmättes rekordsiffror för betalstreamingen i svenska hushåll och konkurrensen om vår skärmtid tätnar. När coronapandemin bromsat filmindustrin så satsar Hollywood hårdare på streamingkanaler.

Stability for Sweden as media spend approaches pre-pandemic levels

Household spend on media services and products in Sweden appear to be returning to pre-pandemic levels.

Analyse: Disney+ stormer frem i Sverige

Få uger efter lanceringen har den amerikanske streamingtjeneste Disney+ nået 450.000 abonnenter i Sverige, vurderer analyseinstituttet Mediavision i en undersøgelse.

Disney+ breaks Nordic growth record

Disney+ has made an impressive start in the Nordic region with Mediavision confident a “substantial” number of households have already signed up. The consultancy estimates that just two weeks after launch 10% of Nordic households already hold a Disney+ subscription.

Disney+ reaches over 10% of Nordic households in first 2 weeks

Approximately 450,000 Swedish households are now paying for a subscription to Disney+, after the streaming service went live in Nordic countries on 15 September, according to consultancy Mediavision.

Disney+ already one of the Nordics’ top SVODs after two weeks

Disney+ has reportedly become one of the top streaming services in the Nordic region after just two weeks of availability.

Så många har Disney Plus i Sverige

Den 15 september lanserades Disney Plus i Sverige och på den nordiska marknaden. Sedan lanseringen uppskattar Mediavision att streamingjätten nu når över 10 procent av de nordiska hushållen.

Ny analys: Disney Plus går som tåget i Sverige – 450.000 hushåll prenumererar

Den nya streamingtjänsten Disney Plus har på knappt tre veckor nått 450 000 betalande hushåll i Sverige, enligt Mediavision. ”De har helt klart slagit sig in på rekordtid”, säger vd Marie Nilsson.

Många svenskar har blivit Disneykunder

450 000 svenskar har tecknat abonnemang på Disneys strömningstjänst Disney+, skriver analysföretaget Mediavision i ett pressmeddelande. Tjänsten lanserades i Sverige den 15 september.

Många svenskar har blivit Disneykunder

450 000 svenskar har tecknat abonnemang på Disneys strömningstjänst Disney+, skriver analysföretaget Mediavision i ett pressmeddelande. Tjänsten lanserades i Sverige den 15 september.

Många svenskar har blivit Disneykunder

450 000 svenskar har tecknat abonnemang på Disneys strömningstjänst Disney+, skriver analysföretaget Mediavision i ett pressmeddelande.

Industry Events

MIPCOM: 12-15 October 2020, Cannes, France

Broadband World Forum: 13-15 October 2020, Amsterdam, Netherlands

Medientage: 28-30 October 2020, Munich, Germany

American Film Market (AFM): 4-11 November 2020, Santa Monica, USA

NEM: 9-11 December 2020, Zagreb, Croatia

MWC Shanghai: 23-25 February 2021, Shanghai, China

MWC Barcelona: 28 June – 1 July 2021, Barcelona, Spain

*Mediavision will attend

**Mediavision will present