This past week has been crammed with news from all parts of the media industry, both on our home turf in the Nordics as well as from other parts of the world. While waiting for the markets’ Q3 reports, here is a brief summary of this week’s more significant news.

The podcast arena has been in the centre of attention all through 2021. This week, several Nordic actors have amped their game. In Norway, NRK presented several new titles to be added to their line-up this fall – for example a companion podcast to its recent success Maskorama, joining the trend of podcasts centred around a movie or series. Norwegian Aftenposten also presented new audio content for this fall, including Jeg var der, its first podcast to be put behind a paywall on PodMe. Aftenposten owner Schibsted recently acquired a 91% stake in this service. In Sweden, Bauer Media announced the launch of Podplay Live – a new format that will enable conversations between podcasters and listeners during a live broadcast. Älskade Psykopat (“Beloved Psychopath”) is the first title to explore this format. Further, recently launched service Sesamy, that offers audiobooks and e-books through per-item purchases, may soon be adding podcasts to their supply.

Consolidation on the Nordic publishing market continues. Last week, news broke that Danish JP/Politiken has acquired a 70% stake in the fifth largest publishing group in Norway – Kagge Forlag and J.M. Stenersens Forlag. Hence, expanding its Nordic footprint even further, following the launch of publishing house Polaris back in 2017. Meanwhile, Swedish actor Bonnier has withdrawn titles (including Expressen) from Readly in a move to focus on its own e-magazine service Arcy.

In terms of video, the upcoming Nordic launch of HBO Max has been in focus this week as the company communicated further details on the take-off – including that the monthly price will be significantly lower than the current price of HBO Nordic. Content will be produced in the Nordics under the brand Max Originals, including the Swedish comedy Lust with Sofia Helin. At Vox Media’s Code Conference earlier this week, WarnerMedia CEO said that the company will spend more than USD 18 billion on content across all areas of the business in both 2021 and 2022.

As such, the stream of heavy content investments continue – but a possible strike in Hollywood raise worries over potential production delays. 60,000 of Hollywood’s behind-the-scenes workers, including camera operators, script coordinators, and makeup artists, voted to authorize an industry-wide strike on Monday. The union has been advocating for better working hours, safer workplace conditions and improved benefits. Among the demands are higher compensation from streaming services. An agreement made in 2009 allowed streaming services with fewer than 20 million subscribers to pay workers lower-than-standard wages. The intention was to help streaming become more popular, but as it has persisted to this day when streaming holds a significantly different position in the industry, workers call for the agreement to be retracted.

Lastly, we have seen several successful theatrical releases these past couple of weeks as international box office has returned post-pandemic – also in the Nordics. The latest tent-pole title to premiere was MGM/Eon/Universal’s No Time to Die, the final Bond-movie with Daniel Craig in the leading role, which hit USD 121 million in international box office during its opening weekend. These figures are in line with Skyfall, and just below Spectre (-15%).

These are the topics we focus on in this week’s newsletter:

- Swedish households’ appetite for audiobook streaming subscriptions surged in 2021

- BritBox to expand across Nordics via C More partnership

AUDIO

Swedish households’ appetite for audiobook streaming subscriptions surged in 2021

The Swedish audiobook market has seen strong subscriber growth in 2021.

During 2021 (until Q3 2021), approximately 120 000 additional households in Sweden have signed up for a subscription to an audiobook service – 14% increase since the beginning of the year. Storytel, the market leader, shows stable household penetration while several of its competitors have grown.

Further, Mediavision recognizes that customers’ reasons for subscribing have shifted throughout the year. Previously, price was the predominant driver, whereas now customers have increased the focus on differences in content offerings between the services. Going forward, this could lead to a less volatile audiobook market, where churn levels may decrease. Today, churn for audiobook services is nearly double compared to streaming services for video and music. Unique, or exclusive, content plays a significant role in this context.

Read the full press release with commentary from Mediavision’s CEO Marie Nilsson here.

|

|

Insight: Nordic Media & MarketsMediavision’s Insight: Nordic Media & Markets tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. Published bianually. |

|

|

Bookbeat launched in Norway – aims to acquire 100’ subscribers Newspapers sue Meta and Google for decimating their advertising

Amedia acquires Akersposten |

VIDEO

BritBox expands in the Nordics via C More partnership

This week, news broke that BritBox, a streaming service operated by ITV and the BBC is expanding to the Nordics via a partnership with C More. The service will be available Sweden, Finland, Denmark via C More and via TV2 in Norway. Pricing details are yet to be disclosed.

BritBox is a joint venture between ITV plc and the British Broadcasting Corporation (and its commercial arm BBC Studios on services outside the UK). BritBox first launched in the US in 2017. The service didn’t launch on its home turf until 2019. At the time of BritBox’s launch in the UK, ITV pledged to invest up to GBP 65 million in the joint venture over the coming two years. While it is unknown how much BBC has investment in the project, top management said that “they plan to invest tens of millions” into original content. With this expansion, BritBox will be available in eight countries (currently available in the US, UK, Australia, and South Africa) – and there are ambitions to expand to a total of 25 countries.

This announcement follows C More’s two-year agreement with Walter Presents, to launch a curated selection of international scripted series across Sweden, Denmark, Norway, and Finland.

|

|

Streaming pushes production spending in UK to record GBP 6 BN

Viaplay launches in the US via Comcast’s Xfinity platforms

Netflix launches new “Tudum” site

Paramount Plus rolls out 18 “linear channels”

Roku & Google agrees on long-term deal for YouTube (+ YT TV) |

SOCIAL MEDIA

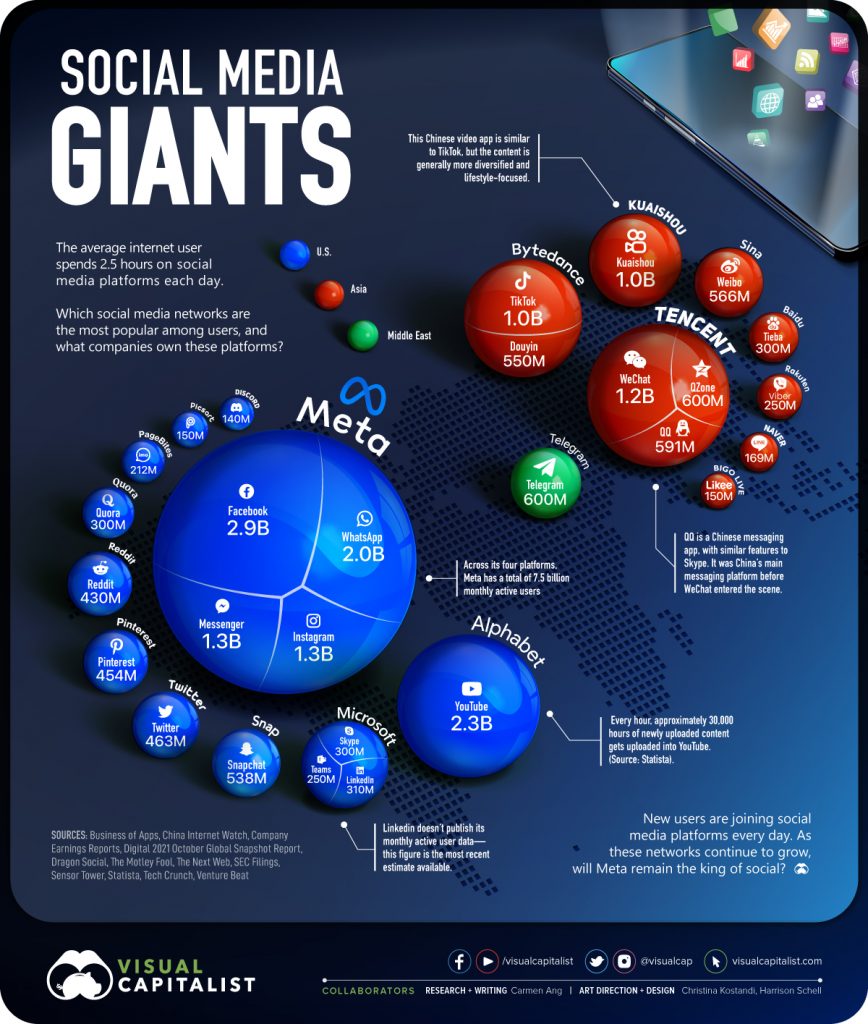

The world’s most popular social networks – and who owns them?

Today, more than 4.5 billion people worldwide use some form of social media, representing about 57% of the total global population. The social media audience is both widespread and diverse, regardless – a very limited number of actors own and control a majority of the most popular platforms. For example, Meta owns four out of the five most widely used platforms. This Visual Capitalist infograpgic offers insight into just how concentrated this market is.

|

|

Swedish rappers joins in on Snoop Dogg’s new album

Universal movies to hit Peacock 45 days post debuting in theaters

Netflix adds three new mobile games for Android

Susanne Bier received honorary award at European Film Awards

Danish producer starts new documentary production company |

Mediavision in the News

Svenskar rusar till ljudböcker – Dagens Industri

Snart betalar en miljon svenska hushåll för en ljudbokstjänst – Boktugg

Vad händer med lägerelds-tv i den digitaliserade världen? – SVT

Marie Nilsson: ”Spenderarbyxorna har gjort barnhushållen högintressanta” – Dagens Media

Spelvärlden biljett till en yngre publik – Dagens Media

Daniel Eks gratis-flört borgar för en ny jättemarknad – DI Digital

Sweden Ups SVOD Sub Base by 350,000 – Media Play News

Ilta-Sanoma, PlayPilot launch streaming guide in Finland – Rapid TV News

|

|

HFPA announces Golden Globe nominees despite ongoing boycott

Discovery Plus’ original Mörkt hjärta to be shown at Sundance

NBA signs Norwegian rights deal with VG

Josef Fares’ It takes two scored triple awards at Game Awards in LA |

Industry Events

The Future of TV Advertising Global: 8-9 December 2021, London

Berlin Film Festival and European Film Market: 10-20 February 2022, Berlin, Germany

CTAM Europe Executive Management Programme: 20-25 March 2022, Fontainebleau, France

MIPTV: 4-6 April 2022, Cannes, France

NEM Dubrovnik: 6-9 June 2022, Dubrovnik, Croatia

* Mediavision will attend

** Mediavision will present