Newsletter 15th of November

NEWSLETTER

15 November 2023

These are the main topics this week:

- The Q3 earnings season is coming to an end

- Sweden Q3: Continued growth in SVOD, but a slowdown looking ahead

- Hollywood actors approves deal to end strike

EARNINGS

The Q3 earnings season is coming to an end

The closing of the Q3 earnings season is approaching. Viaplay Group remains, since the company postponed its Q3 presentation a few weeks ago. Here are some of the highlights from last weeks’ reports:

- Disney’s revenue increased 5% YOY to USD 21.24 billion, compared to USD 20.15 billion for the same period last year.

- The company added 7 million new Disney+ subscribers from the previous quarter, bringing its total number of users to 150.2 million which exceeded Wall Street’s forecast.

- Disney revealed plans to continue to “aggressively manage” its cost base, increasing its cost-cutting ambitions by an additional USD 2 billion to a target of USD 7.5 billion.

- Disney’s shares rose more than 4% after the closing bell on Wednesday.

- Paying subscribers of Readly were 460,686 in Q3, an increase of 3.1 percent compared to Q3 2022.

- Total revenues amounted to SEK 173.9 million, an increase of 18.2 percent from SEK 147.1 million in the third quarter of 2022.

- Readly’s operating loss amounted to SEK 3.6 compared to a loss of SEK 20.6 million in Q3 2022.

- Average revenue per user (ARPU) rose from SEK 103 to SEK 120 in Q3, mainly driven by recent price increases.

- Warner Bros. Discovery reported a net loss of USD 417 million for the third quarter, which is an improvement from the USD 2.31 billion loss the company reported in Q3 2022.

- Revenue for WBD rose 2% YOY to USD 9.98 billion which was in line with analysts’ expectations.

- Warner Bros. Discovery’s total direct-to-consumer subscribers grew by 0.1 million YOY to 95.1 million, but decreased QOQ by 0.7 million.

- Ad revenue in the TV networks segment fell -12% YOY, primarily driven by audience declines in domestic entertainment, news networks and weak advertising market in the US.

- The company’s stock closed at -19% last Wednesday after the report.

|

|

Insight: Nordic Media & MarketsThis analysis tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. Published biannually. |

VIDEO

Sweden Q3: Continued growth in SVOD, but a slowdown looking ahead

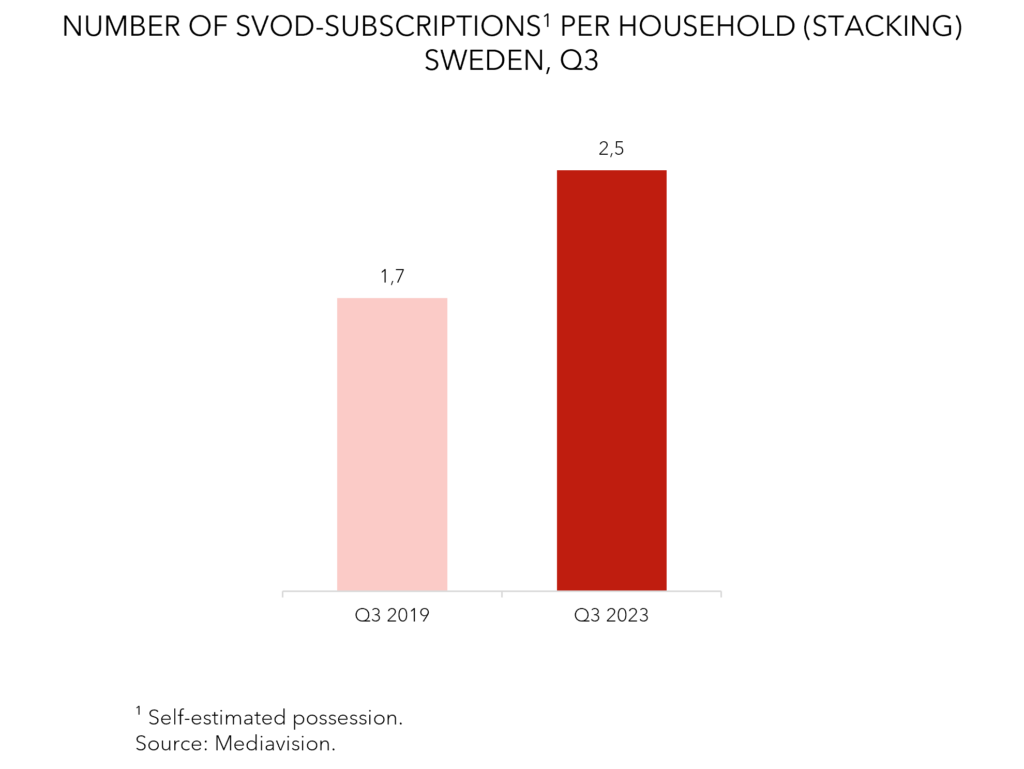

Paid streaming services, SVOD, are now found in almost 70 percent of the Swedish households, with an average of 2.5 services per household. Over recent years, growth has primarily been driven by households opting to subscribe to multiple services. However, in the upcoming 12 months, the consumers indicate a slowdown in their acquisition plans. Mediavision’s conclusion is that continued growth will likely call for a carrot and stick approach – meaning that a variety of offerings, and prices, will be needed.

Today, close to 70 percent of the Swedish households have at least one SVOD service. A subscribing household on average pay for 2.5 services. Over the past year, the number of subscriptions per household has grown by eight percent, in line with the average annual growth since 2019. The main driver of market growth in recent years is the existing households that acquire more subscriptions. Over the next 12 months however, consumer acquisition plans suggest a break in the upward trend, indicating an unchanged number of subscriptions per household. This is concluded in Mediavision’s Q3 analysis of the Swedish TV and streaming market.

Despite the more negative attitude of the consumers, there are ways to achieve continued growth. Restrictions in account sharing is one method for actors to gain more customers. Another is to offer hybrid packages, i.e. less expensive with advertising (as several streaming actors now are launching).

– The streaming market is maturing, which of course means a slowed down growth. For the SVOD services, it will now be about how to navigate in this new landscape. There are several ways to address this, such as offering cheaper or hybrid subscriptions including ads. Several services have launched HVOD this fall and many customers will appreciate this alternative, comments Marie Nilsson, CEO of Mediavision. The services become cheaper, or in some cases, free. Paired with a stricter policy on password sharing, the intention is to push revenues further. In the long run, costs and revenues must be balanced, which has not been the case for several streaming actors in recent years.

|

|

Insight: Nordic TV & StreamingThis analysis covers both the TV- and streaming markets in the Nordic countries. It rests on three pillars: the consumers, the market, and the actors. Analyzing the consumers takes us far – but not all the way. Studying the actors and the market as a whole is just as important. |

|

|

Nintendo confirms live-action Zelda movie is in the works

Amazon cuts games unit jobs in broader restructuring

Allente releases new flexible streaming packages

Bonnier News & Schibsted join Kantar Sifo online video measuring

|

VIDEO

Hollywood actors approve deal to end strike

SAG-AFTRA, the union representing the Hollywood actors, have approved an agreement with the Alliance of Motion Picture and Television Producers (AMPTP), thereby ending the longest actors strike against the film and TV studios in Hollywood history.

The new deal includes the first-ever protections for actors against artificial intelligence, as well as a historic pay increase with most minimum wages increasing by seven percent. The deal also includes a so called “streaming participation bonus” for high-performing original streaming series and films. The official approval was announced by SAG-AFTRA at a press conference last Friday. This means that Hollywood can resume production for the first time since May, as the Hollywood screenwriters’ strike also ended in late September.

The two strikes have affected many parts of the industry and will continue to ripple for some time to come. Perhaps one of the most obvious effects is the delays of films and series. Not long after the tentative agreement was signed by SAG-AFTRA, Disney delayed the release of several films as Hollywood studios adjusted schedules following the four-month actors’ strike. The third Deadpool movie, which had originally been scheduled to reach theaters in May, will now debut in late July. Consequently, the company has pushed its planned July release, Captain America: Brave New World, to February 2025.

As Hollywood productions have been cancelled for months, many titles will be postponed. For Netflix, Theres been a lot of buzz around the effects on the final season of Stranger things. Reports suggest that the new season could resume its production as early as this week. For Warner Bros. Discovery, the movie Dune: Part Two which was initially scheduled to premiere in theaters this month, has now been rescheduled for March next year.

|

|

Pluto TV secures the rights to handball Champions League

Danish Sport Live buys the rights to Spanish cup football

SVT to gets partial rights for Women’s Champions League

Paramount+ app launches on Xbox across international markets

|

Mediavision in the News

Marie Nilsson: Så påverkas innehållet av tv-krisen – Dagens Media

Sweden: Household media spend reaches record level in Q3 – Senal News

Köp av medietjänster ökar: ”Ett hyfsat billigt nöje” – SR

Svenske husstandes medieforbrug slår ny rekord – Mediawatch

Trots krisande marknad – medieutgifterna ökar – Dagens Media

Summerat: Svenskarnas kontodelning kostar en miljard – Tidningen Näringslivet

Trots tuffa tider för hushållen – många fortsätter betala för strömningstjänster – SVT

Så slår krisen mot tv-tittarna – Göteborgs-posten

Svenskarnas kontodelning kostar jättarna nära 1 miljard kronor – Dagens Industri

Trendbrott: Fler svenskar piratkopierar film och tv – Dagens Nyheter

Industry Events

Stockholm Film Festival: 8-19 November 2023, Stockholm, Sweden**

MIPTV: 15-17 April 2024, Cannes, France

* Mediavision will attend

** Mediavision will present