Newsletter 8th of February

NYHETSBREV

8 February 2023

The main topics this week:

- Mediavision: TVOD reaches record levels in 2022

- The Q4 earnings season continues

- Viaplay sets US and Canada direct-to-consumer launch dates

- Details on Netflix’s password sharing prevention has been revealed

TVOD

Mediavision: TVOD reaches record levels in 2022

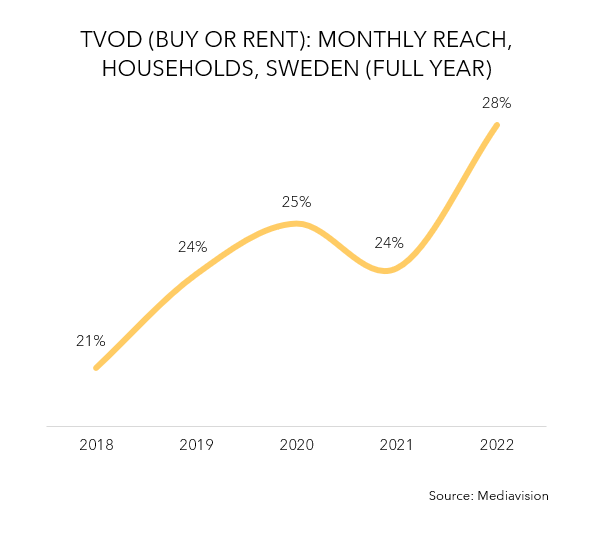

In 2022, the number of cinema visits in Sweden is still 5.5 million lower than 2019, the year before Covid. This is shown by statistics from the Swedish Cinema Owners Association. Buying or renting video online, TVOD, on the other hand, grew strongly in Sweden last year. Close to 30 percent of Swedish households have rented or bought content this way an average month in 2022. This is a new record for TVOD in Sweden.

An average month in 2022, 28 percent of the Swedish households rented or bought TVOD content. TVOD is an abbreviation of “transactional video on demand”, which is the digital streaming service for what used to be “video rental store”. Compared to 2021, TVOD has grown with 15 percent which is a new record level. This also means that household spend on TVOD has increased by nearly six percent compared to 2021. This is shown in Mediavision’s latest analysis of the Swedish TV & Streaming market.

Read up on the full press release here, with commentary from Mediavision’s CEO Marie Nilsson.

EARNINGS

Q4 earnings season continues

The past week, we have received reports from some of the biggest actors in the media sector. Here are some highlights of what’s been reported.

Alphabet

-

- Google-owner Alphabet’s revenue was USD 76.05 billion in Q4 2022, up 1% year-over-year.

- YouTube advertising revenue was USD 7.96 billion in the fourth quarter — down 8% from USD 8.63 billion in Q4 2021.

- YouTube Shorts has surpassed 50 billion daily views in the fourth quarter.

- AI was a big focus during the call and CEO Sundar Pichai said, “Very soon, people will be able to interact directly with our newest, most powerful language models as a companion to Search, in experimental and innovative ways.”

- The company’s stock gained 7.28% in normal trading hours but dropped nearly 4% after hours.

A few days after the report, Google announced the launch of AI chatbot Bard. For now, it’s only available for trusted testers but will launch more widely to the public in the coming weeks.

Amazon

-

- Net sales increased 9% to USD 149.2 billion in the fourth quarter, compared with USD 137.4 billion in fourth quarter 2021.

- Amazon detailed the costs of its content business, citing that its content expenses landed at USD 16.6 billion in 2022, a 28% increase from USD 13 billion in 2021.

- Amazon did not report subscriber numbers for its streaming business. However, Amazon’s CFO Brian Olsavsky stated during the earnings call that its Prime Video content is a “strong driver of Prime member engagement and new Prime member acquisition.”

- Shares fell 2% in after-hours trade, after they had gained 7% before the market closed Thursday.

Apple

-

- Apple’s quarterly revenue for the quarter ending December 31th 2022 (Apple’s fiscal Q1) was USD 117.2 billion, down 5% year-over-year.

- This is Apple’s first year-over-year quarterly revenue decline since 2019 and its biggest annual quarterly revenue drop since September 2016.

- CEO Tim Cook said three factors affected the results: the strong dollar, production issues in China affecting production of the latest Iphones, and the overall macroeconomic environment.

- The stock dropped by 3% in pre-market trading the morning after the earnings release.

Meta

-

- Monthly active users for Meta were 2.96 billion in Q4, an increase of 2% year-over-year.

- Revenue for the social media giant came in at USD 32.17 billion a 4% decline year-over-year, but above the USD 31.53 billion expected from analysts.

- Meta said that it authorized a USD 40 billion increase to its stock repurchase plan. The company bought back USD 27.9 billion worth of its shares last year.

- Meta’s shares rose as much as 20% in off-hours trading, as the company pointed to early signs of improvement.

Telenor

- Total revenues for the Norwegian telecom operator were NOK 25.4 billion, which is an increase of NOK 0.5 billion compared to the same period last year.

- Mobile service revenues in Telenor Nordics increased by 5% year-over-year.

- For 2023, Telenor expects low to mid-single digit growth for both service revenues and EBITDA in the Nordics.

- Telenor shares rose 7% following the report, recovering from a ten-year low of 87.60 set on December 20th and reaching their highest level since August 25th last year.

|

|

Insight: Nordic Media & MarketsThis analysis tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. Published biannually. |

|

|

Peacock no longer offers its free tier to new customers

Mats Strandberg’s bestseller The Conference comes to Netflix

Holy Spider grabs 11 statuettes at the Robert Film Awards

Norlys and Stofa raise the prices of TV packages |

SVOD

Viaplay sets US and Canada direct-to-consumer launch dates

This morning, Viaplay announced launch dates for its direct-to-consumer streaming service in Canada and the US. The launch date for the US is on 22nd of February and in Canada on 7th of March. At launch, the service will hold more than 1,500 hours of European content, including Nordic Noir dramas.

Nordic Noir is referred to as high-quality, psychologically penetrating crime drama from the Nordic region. Viaplay Group’s Chief Commercial Officer for North America & Viaplay Select, Vanda Rapti, says, “Viaplay will show more of this unique content in North America than any other streamer – and Nordic Noir is just the beginning”.

The service will be priced at USD 5.99 and CAD 6.99 per month in the US and Canada respectively. With Viaplay’s North American launch, its direct-to-consumer service will be available at 13 markets.

|

|

Insight: Nordic TV & StreamingThis analysis covers both the TV- and streaming markets in the Nordic countries. It rests on three pillars: the consumers, the market, and the actors. Analyzing the consumers takes us far – but not all the way. Studying the actors and the market as a whole is just as important. |

|

|

Tidal & Universal Music Group partner to develop more artist

Beyoncé breaks record for most Grammy wins of all time

Michelle Obama’s new podcast premiers exclusively on Audible

Perfect Day Media adds three new podcasts to its lineup |

SVOD

Details on Netflix’s password sharing prevention has been revealed

During its Q4 earnings call a few weeks ago, Netflix revealed that efforts against password sharing will roll out broadly within the upcoming months. Details have now surfaced on how Netflix aims to limit password sharing for usage outside the household. The streaming giant has updated its FAQ pages in countries where testing of extra membership fees for account sharing already rolled out — in Chile, Costa Rica and Peru.

The new terms ask users to define a primary location via their TV. All the accounts and devices should then be connected to the same Wi-Fi as the TV. After that, people living in this home, and want to use Netflix on their own devices, must launch the app at home at least once every 31 days. In case of travelling, the main account holder will be asked to verify the device for you. The account holder will then receive a code that they can send to the person who is traveling. If the verification is successful, the traveling member can watch Netflix for seven more days. It is unclear how often or how many codes the account holder can request.

Netflix has not confirmed its plans to cancel password sharing yet. A Netflix spokesperson said the info on its FAQ pages only is applicable for the Latin American countries where it rolled out the “Extra Member” feature last year. So, it remains to be seen what actions Netflix will take in the Nordics and other countries to limit password sharing and purchase sub-accounts for users outside of households, but this might give us a glimpse of what’s ahead.

Mediavision in the News

Netflix drag – så ska kontodelare jagas – Svenska Dagbladet

Marie Nilsson: 2023 kan bli hybridtjänsternas år – Dagens Media

Stort tapp för nya poddar i världen – “Kärvare läge” – Sveriges Radio

Netflix tros redovisa 4,5 miljoner nya prenumeranter – Omni

Nordics: 3 million SVOD accounts are borrowed from other households – Piracy Monitor

Millioner af abonnementsdelinger i Norden rammer Netflix hårdest – Mediawatch

3 million Nordic VOD subscriptions ‘borrowed’ from another household – Broadband TV News

Industry Events

Filmfestival: 27-05 January/February 2022, Göteborg, Sweden

Media Summit: 15 March 2023, Stockholm, Sweden **

Radiodays Europe: 26-28 March 2023, Prauge, Czech Republic

MIPTV: 17-19 April 2023, Cannes, France

* Mediavision will attend

** Mediavision will present