Newsletter 16th of March

NEWSLETTER

16 March 2022

These are the topics we focus on in this week’s newsletter:

- Discovery Plus and HBO Max will be one

- CNN Plus sets launch date – to join Warner Bros. Discovery service?

- Strong growth for Egmont in 2021

SVOD

Discovery Plus and HBO Max will be one

In May last year, news broke that another mega merger was set to take place in the world of TV and streaming – AT&T would combine its WarnerMedia with Discovery Inc, with the goal to form a premier, standalone, global entertainment company.

Last week, it was confirmed that the final hurdle was cleared as the Discovery shareholders approved the USD 43 billion acquisition. The Boards of Directors of both AT&T and Discovery have already approved the transaction. While AT&T will retain a stake in the new company, CEO John Stankey has indicated that the company looks to exit the entertainment business after the completion of its sale of WarnerMedia.

The new company, which will be renamed Warner Bros. Discovery within the next month, will bring together over 100 brands including HBO, Warner Bros., Discovery, DC Comics, CNN, Cartoon Network, HGTV, Food Network, the Turner Networks, TNT, TBS, Eurosport, Magnolia, TLC, Animal Planet, and ID. And this week, Discovery confirmed that it plans to combine its current streaming service Discovery Plus, which launched early in 2021, with recently launched HBO Max into one service, rather than offering a bundle of the two platforms.

So, what does this mean for consumers in the Nordics? Whereas details on pricing and packaging are yet to be disclosed, the potential content supply of the combined service might provide an interesting first indication of what the new service will bring to the table.

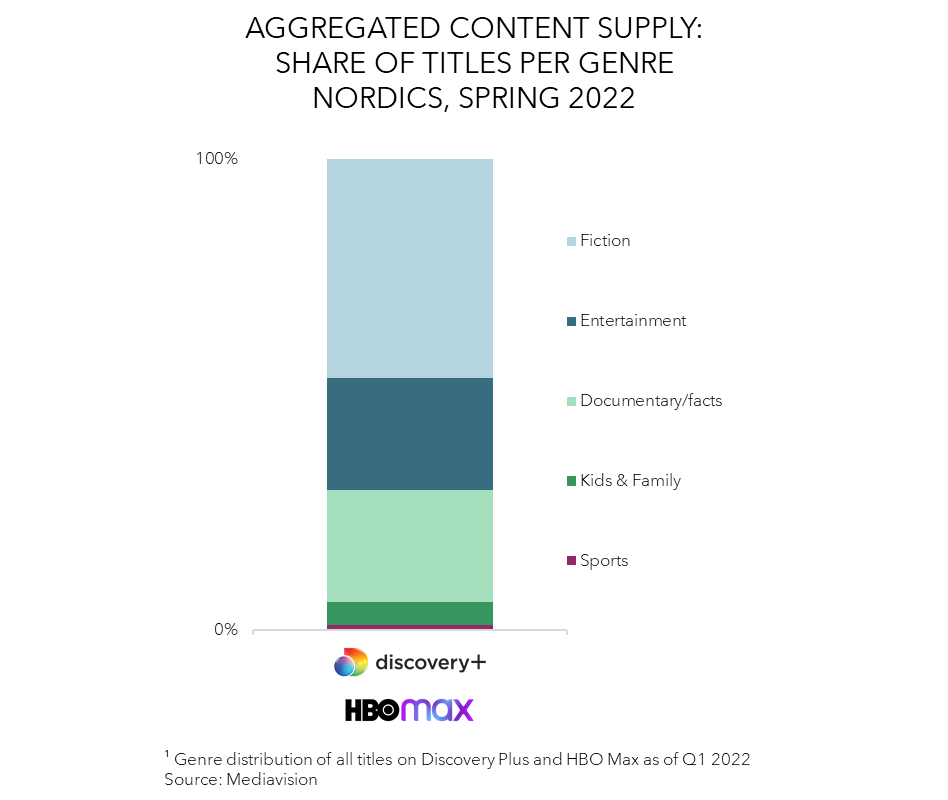

Mediavision’s content supply analysis shows that Discovery+ has a strong focus on non-fiction content, while HBO Max’s supply is skewed towards foreign fiction. Hence, bringing the two together would mean that the combined service would better match the demand of Nordic streaming consumers, according to Mediavision data on viewing by genre. However, it should be noted that this graph does not include live broadcasts of sports. Discovery currently holds the rights to some of the most popular rights in the Nordics, including Allsvenskan, Eliteserien and Tour de France.

|

|

Content AnalysisCompetition on the Nordic streaming market is intensive. As more services are launched and the supply increases, the interplay between content, subscriptions, and market position becomes even more important. What type of content drives growth – and what keeps consumers loyal? |

|

|

Tele 2 and Viaplay agree Swedish distribution partnership

Spotify and FC Barcelona announce partnership

Amazon may be days away from closing MGM deal

Podcasts fastest growing advertising category in Norway 2021

Discovery Plus series Alt du elsker kan vinne nominated in Cannes

Podimo to double its catalogue – aims to offer 110 podcasts in 2022 |

SVOD

CNN Plus sets launch date – to be bundled with new Warner Bros. Discovery service?

The Discovery merger was not the only Warner-related topic in the spotlight this week. Warner has also set a launch date for its new streaming service CNN Plus. While it is still uncertain whether (or when) the service will be available in the Nordics, it is set to make its debut in the US on March 29th.

The service will be priced at USD 5.99 a month, or about USD 60 a year. Subscribers who sign up during the first four weeks will receive 50% off the monthly subscription price “for life,” as long as they remain subscribers, which is the same promotion applied at the launch of HBO Max. CNN Plus will include at least eight live daily shows and at least 11 weekly shows, along with more than 1,000 hours of on-demand programming, including original series and movies. Subscribers will be able to submit questions live and in advance for select interviews, with the ability to vote for questions they want answered.

Further, sources familiar with CNN Plus have indicated that there’s a strong probability that CNN Plus will be bundled in some fashion with the new combined HBO Max and Discovery Plus service.

COMPANY REPORTS

Strong growth for Egmont in 2021

This past week, Danish media group Egmont (owner of Norwegian TV 2) presented its report for the full year of 2021 – which presented growth in all business areas.

The full year of 2021 turned out to be the strongest year to date for Egmont, with total revenues amounting to a total of EUR 1.2 billion, +34% growth year over year or EUR 0.5 billion. Approximately half of the revenue growth was organic, while the other half was a result of Egmont becoming the sole owner of Norway’s largest book publisher, Cappelen Damm, and Norwegian TV distributor RiksTV, acquiring e-commerce company Royal Design Group and increasing its holdings in a number of growth businesses.

-

- TV 2 Norway

Revenues increased by 33% year over year for TV 2 Norway, equivalent to EUR 154 million. Hence, total revenues amounted to EUR 618 million for the full year of 2021. This means that for the first time, TV 2’s revenues surpassed NRKs total revenues. TV 2 Play saw further growth and reached 780,000 subscribers by the end of the year. TV 2 also became the sole owner of RiksTV, which distributes pay TV in the Norwegian terrestrial digital network and operates the streaming service Strim.

- TV 2 Norway

-

- Nordisk Film

Revenues increased by EUR 106 million year over year, corresponding to 29% – despite Nordisk Film’s 46 cinemas in Denmark, Norway and Sweden being forced to close for five months. Highlights during the year included the Oscar win for Thomas Vinterberg’s Another Round and Checkered Ninja 2 being the highest-grossing Danish film ever, with 930,000 tickets sold.

- Nordisk Film

-

- Egmont Books

This business area, now encompasses the Norwegian publishing house Cappelen Damm and Danish book publisher Lindhardt og Ringhof, as Egmont became the sole owner of Cappelen Damm in 2021 – resulting in a non-recurring gain of EUR 55m from adjustments to the value of its original holding. Revenues amounted to EUR 163 million in 2021, compared to 63 million in 2020.

- Egmont Books

Aside from this report, the past week has been eventful on both the Danish and Norwegian markets:

-

- TV 2 Denmark announced that its Play service has surpassed 900.000 subscribers

- TV 2 Norway announced that it will now offer Disney Plus to its subscribers

- Telia Norway presented a new agreement that brings Netflix to its offering

- Telia Denmark imposed a record high price hike on its TV-packages

|

|

Warner Bros. is creating 6 million DC Comics NFTs

LimeWire is back – as a NFT marketplace for music

Tiktok launches music distribution platform Sound On

NBCUniversal ends Hulu content sharing deal

US recorded music market grew 23% in 2021

Global box office down 50% from pre-pandemic times in 2021 |

Mediavision in the News

Netflix faces Nordic challenges – Broadband TV News

Swedish music subscriptions grew 7% in 2021 – High Resolution Audio

Så mycket dyrare har det blivit att strömma film och serier – SVT

Tufft år för svenska ljudboksbranschen – tillväxttakten halverades – Dagens Industri

Could TikTok spur growth of AVOD in the Nordics? – Senal News

Bråket visar varför Spotify behöver Rogan – SVD

Poddarna – makten och pengarna – SR

Därför kom Clubhouse-hysterin för ett år sedan – och därför dog den – SR

Hushållen tecknar fler abonnemang – rekordsiffror för S-SVOD under 2021 – Dagens Media

Industry Events

CTAM Europe Executive Management Programme: 20-25 March 2022, Fontainebleau, France

Copenhagen Future TV Conference 2022: 7 April 2022, Copenhagen**

MIPTV: 4-6 April 2022, Cannes, France

NEM Dubrovnik: 6-9 June 2022, Dubrovnik, Croatia

* Mediavision will attend

** Mediavision will present