Newsletter 1st of February

NYHETSBREV

1 February 2023

The main topics this week:

- Mediavision Industry outlook 2023

- The Q4 earnings season continues

OUTLOOK

Mediavision Industry Outlook 2023

For the fourth consecutive year, Mediavision has asked stakeholders in the Nordic media industry to share their view on the future development of the Nordic market. The results of this survey, supplemented with reflections and analysis from the Mediavision team, is presented in Mediavision Industry Outlook 2023 – which is now available to all of you upon request – please send an email to anton.ljung@mediavision.se to get your hands on a copy.

Here are some of the main takeaways from this year’s edition.

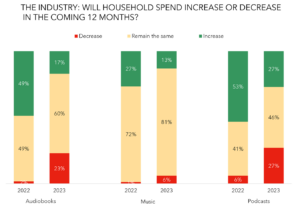

Audio 2023: Podcasts and audiobooks up for a struggle?

The general view of the industry when it comes to household investments, is that it will be more stable in 2023 than previous year. In last year’s survey, about half of the respondents believed that household spend on audiobook subscriptions would increase – significant lower for 2023 as only 17% belive in an increase of audiobook subscriptions.

Music is the category that most of the respondents believe will remain stable in household spend during 2023 (81%). The industry’s view on podcasts is similar to that of audiobooks – more than half believe household spend would increase in 2022, now that number is down to 17% for 2023.

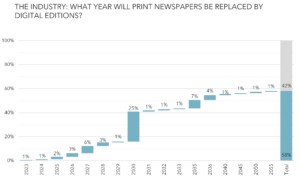

Text: Half of respondents believe print newspapers will be fully replaced by digital before 2035

Printed newspapers are being replaced by digital editions to a greater extent. It is generally believed that print will be phased out completely at some point. 42% of the respondents predict that digital will not replace printed newspapers in a foreseeable future. About half of the respondents believe this will happen before 2035.

In household spend of text, digital magazine subscriptions see a radical decrease as 62% of people in the industry believe that household spend will decrease in 2023. It’s a more stable outlook for digital newspaper subscriptions as 53% believe the household spend will be stable in 2023 – although, 35% believe in a decrease for digital newspaper subscriptions, compared to only 5% in last year’s survey.

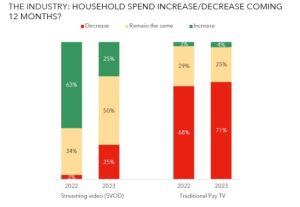

Video: Stability for SVOD, heavy decrease for pay TV

Following multiple years of double-digit growth for SVOD, the market is now stabilizing. Half of the respondents believe that household spend for SVOD will remain stable in 2023 – the other half are evenly divided between an increase and a decrease. This is a big shift in shares compared to when the same question was asked a year ago – then, 63% believed that household spend for SVOD would increase.

Household penetration and spend on traditional pay TV has proven quite resilient recent years, despite strong growth in SVOD¹. Nevertheless, the industry shows weak confidence in the resistance of trad pay TV – 71% believe spend will decrease, a slight change from last year (68%).

¹ Mediavision analysis ‘Insight: Nordic TV & Streaming’

|

|

Insight: Nordic TV & StreamingThis analysis covers both the TV- and streaming markets in the Nordic countries. It rests on three pillars: the consumers, the market, and the actors. Analyzing the consumers takes us far – but not all the way. Studying the actors and the market as a whole is just as important. |

|

|

Bahnhof and Allente in cooperation for TV customers

Samsung may license TV Plus app to third-parties

Peacock reaches 20m paid subscribers in Q4

SkyShowtime expand to eight new markets

HBO’s The Last of Us gets a second season after successful debut |

EARNINGS

The Q4 earnings season continues

- The U.S. phone service provider added 217 million subscribers across all of its divisions in Q4, exceeding Wallstreet estimates of 215 million.

- Total revenue for AT&T landed at USD 31.3 billion, compared to USD 31.1 billion in Q4 2021, a slight increase of 0.8%.

- After the report, shares of AT&T closed +6% higher on Wednesday, trading at USD 20 per share.

- Total revenue for Spotify grew +18% year-over-year to €3.2 billion.

- Spotify’s monthly active users landed at a record high 489 million, resulting in a 20% increase year-over-year and 10 million over guidance.

- Premium Subscribers grew 14% Y/Y to 205 million, 3 million above guidance.

- Spotify’s popular summary-feature Wrapped was released for the 8th time in Q4 2022, which grew 30% year-over-year un user engagement and now draws more than 150 million monthly active users.

- Spotify shares closed up 12% Tuesday after the company reportedfourth-quarter earnings

- Telecom operator Tele2’s results for Q4 were in line with the guidance.

- Total revenue of SEK 7.5 billion increased by +4% organically compared to Q4 2021.

- End-user service revenue ended at SEK 5.1 billion, increased by +3% organically compared to Q4 2021, due to strong performance in the Baltics and B2B in Sweden.

- The company also raised the dividend to SEK 6.8, from last year’s SEK 6.75.

- Service revenues for Telia increased +3.9% year-over-year to SEK 20,174 million.

- For the full year of 2022, operating income decreased to SEK -9,417 million from 15,232 in 2021, impacted by non-cash impairments.

- The number of SVOD subscriptions slightly increased in 2022, from 771,000 in 2021 to 785,000 in 2022.

- During the call, Telia’s CEO Allison Kirkby stated that “the temporary loss of Viaplay, before the new distribution agreement was struck in early December, impacted revenue in the quarter and slowed our ability to adjust prices”.

More company reports are scheduled in the upcoming weeks, stay tuned!

|

|

Insight: Nordic Media & MarketsThis analysis tracks the progress of individual and household payments per service and actor, as well as overall media expenditures. The primary focus is mapping out the allocation of expenditures across audio, video, text, and access. Published biannually. |

|

|

Bonnier News increases the bid for Readly

Men’s World Handball final nets strong ratings in Denmark

NFC stops publishing the free magazine Kriminalteknik

Viaplay Group enters Dutch distribution deal with Solcon |

Mediavision in the News

Netflix tros redovisa 4,5 miljoner nya prenumeranter – Omni

Nordics: 3 million SVOD accounts are borrowed from other households – Piracy Monitor

Millioner af abonnementsdelinger i Norden rammer Netflix hårdest – Mediawatch

Så många delar sina SVOD-abonnemang – Dagens Media

3 million Nordic VOD subscriptions ‘borrowed’ from another household – Broadband TV News

Tross økonomisk uro ser vi få tegn til at nordmenn vil redusere sine mediekjøp –Kampanje

Miljoner tittare delar på strömningsabonnemang –Sveriges Radio

Research: 3m in Nordics use borrowed SVOD login – Advanced Television

”Lågkonjunktur gör att människor kollar mer tv” – Svenska Dagbladet

Industry Events

Filmfestival: 27-05 January/February 2022, Göteborg, Sweden

Media Summit: 15 March 2023, Stockholm, Sweden **

Radiodays Europe: 26-28 March 2023, Prauge, Czech Republic

MIPTV: 17-19 April 2023, Cannes, France

* Mediavision will attend

** Mediavision will present